Money Making Source

Wednesday, September 2, 2015

Wednesday, February 19, 2014

How to check multiple banks personal loan interest rate in 1 Minute

If you are eligible for personal loan you may have a confusion which bank offers the low interest rates. where as No bank offers the same interest rate that varies from bank to bank

Steps to check your Interest Rates from various banks

Step 1

Before checking bank loan interest rate check your eligibility here. This calculator will get all the requirements necessary to find your eligibility, as this is unsecured loan the information you give will be more value for banks to finalize your loan

Step 5

Its time for you to choose your bank, you can pick any bank as your wish. You can pick the bank with low interest rate or select the bank with less processing fee

Steps to check your Interest Rates from various banks

Step 1

Before checking bank loan interest rate check your eligibility here. This calculator will get all the requirements necessary to find your eligibility, as this is unsecured loan the information you give will be more value for banks to finalize your loan

|

| Eligibility checking form |

Step 2

If you are eligible your loan amount will be displayed in a yellow notice

Step 3

Now your loan got finalized its time to check your interest rate. Before finding the interest rate you will be taken to a form this details will help us give a manual assistance to proceed further

Step 4

Now your taken to the finalized interest rate by comparing various bank in your city.Step 5

Its time for you to choose your bank, you can pick any bank as your wish. You can pick the bank with low interest rate or select the bank with less processing fee

Thursday, February 13, 2014

How to Check your are Eligibility for Personal Loan in One Minute

Before walking to each bank you should know will i eligible for Personal loan

Its is not true when single banks rejects your loan you are not eligible for it, the requirements varies from bank to bank

Some tool in online will check your requirements with different banks and displays a list of banks that are ready to offer you the loan with a detailed information of interest rate offered for you. You can compare the different interest rate and can get your loan from low interest rate banks

of interest rate offered for you. You can compare the different interest rate and can get your loan from low interest rate banks

Some tool in online will check your requirements with different banks and displays a list of banks that are ready to offer you the loan with a detailed information

of interest rate offered for you. You can compare the different interest rate and can get your loan from low interest rate banks

of interest rate offered for you. You can compare the different interest rate and can get your loan from low interest rate banks

Step to Check your Loan Eligibility

Step 1

Search for Rupeezone Personal Loan Eligibility you will be resulted to Rupeezone Personal loan page GOTO http://www.rupeezone.in/personal-loan-eligibility-calculator.php

Step 2

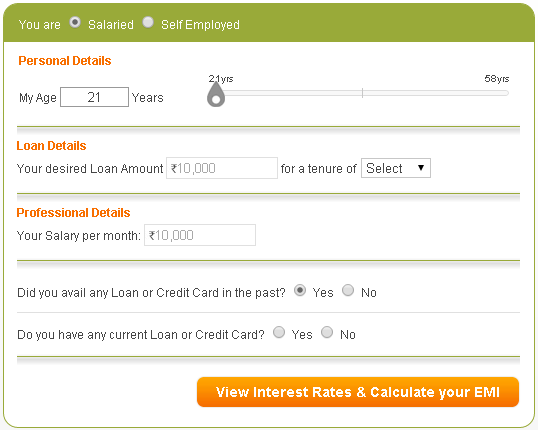

By entering the details like Personal Details, Loan Details, Professional Details will help the banks to calculate your loan eligibility and analyze your repaying capacity.

Step 3

Enter your Age or adjust the interactive tool to feed your age, make sure minimum age to apply personal loan is 21 years

Step 4

Step 3

Enter your Age or adjust the interactive tool to feed your age, make sure minimum age to apply personal loan is 21 years

Step 4

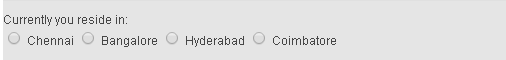

Click the current city you are reside in, this help to list banks ready to offer you loan in in your city

Step 5

Step 5

Step 7

Now you are entering your favorite area, it is a place you can enter your loan amount

Step 8

This is your loan judgement area - You will be feeding your salary, company you work, nature of industry, work experience, total experience

Note - While you typing your company, your current working company should shown in auto suggestion while typing, only the listed company will be eligible for loan

Step 9

If you availed any loan or credit card previously will help banks to check your previous repaying quality.

Step 10

Are you paying any loan currently make your answer here, this is to check your repaying capability

Step 11

Now you are eligible with a loan amount of 4 lac from one bank

Rupeezone Personal loan eligibility calculator will complete your bank to bank loan searching process in one minute

Friday, February 7, 2014

8 Steps to Check your Maximum Loan Amount from various banks

Labels:

nisha

What's my Loan Amount

Before Applying, finalize your maximum loan and start planing it

Steps to Check my Maximum Loan

Step 1

Search for "Rupeezone Personal Loan Eligibility" your search will resulted to Rupeezone Personal Loan Eligibility Page GOTO this page http://www.rupeezone.in/personal-loan-eligibility-calculator.php

Step 2

Enter your Age, minimum age to Apply is 21

Step 3

Enter your City, it can be the city you reside or working, a temporary or permanent addressStep 4

Check your Current residential place, it can be self owned house, parent owned house, bachelor room, company provided house, or rental house

Step 5

Check your time Period of your current Residence

Step 6

Now your in your favorite place, you can enter your loan amount you wish to get from banks. Remember you minimum loan amount you can get is 50,000, so enter Rs. 50,000 and above

Tenure- how many years you take to pay your loan amount

Step 7

Professional Details - This is the critical step that finalize your loan amount, here you should prove your good enough to get If you are a good salaried from a reputed company your loan is ready.

you can view your maximum loan amount in the right side yellow notice

Step 8

say Yes or No for your previous loan and credit card you availed and used from any of the banks. This is to check your re-paying quality

say Yes or No for current loan you availed from any of the banks. This is to check your repaying capacity

Subscribe to:

Posts (Atom)